Long-read

A roadmap for economic renewal

Ordinary people must take the lead in our post-Covid recovery.

Want to read spiked ad-free? Become a spiked supporter.

There is much talk from inside and outside government about a state-administered ‘reset’ or ‘reboot’ in order to begin Britain’s economic recovery. But the economy needs something much more far-reaching – namely, a bold and comprehensive reconstruction.

A reboot, like switching your computer off and on again, implies the economy was functioning okay before, and just needs a stimulus to get going again. But this disregards the parlous state of the economy pre-Covid, and therefore ignores the scale of the overhaul required.

The fundamentals of Britain’s economic depression were in place long before Covid-19. These include a declining trajectory for business investment, held back by decades of flagging profitability; languid productivity growth, with barely any trend improvement in how much workers are able to produce per hour since the start of the 2000s; paltry growth in personal incomes, in particular for people not working at managerial level; and a rising proportion of the workforce in low-value and relatively insecure jobs.

These problems are likely to be exacerbated by the current economic disruption. A lot of businesses and jobs will be destroyed in the months ahead, and there is nothing inevitable about the emergence of new businesses and good jobs to replace them. Partly, this is because depressions become self-perpetuating. Weak economic activity dampens incentives for starting up or for investing in existing operations. We saw this at work during the 1930s, when an economic slump dragged on until the impetus of fighting the Second World War forced the economy’s disruptive transformation.

Short-termist government interventions of the past three-or-so decades have augmented the grim depression cycle. State policies, which have allowed businesses to continue despite the decay in their profitability, have become barriers to economic renewal.

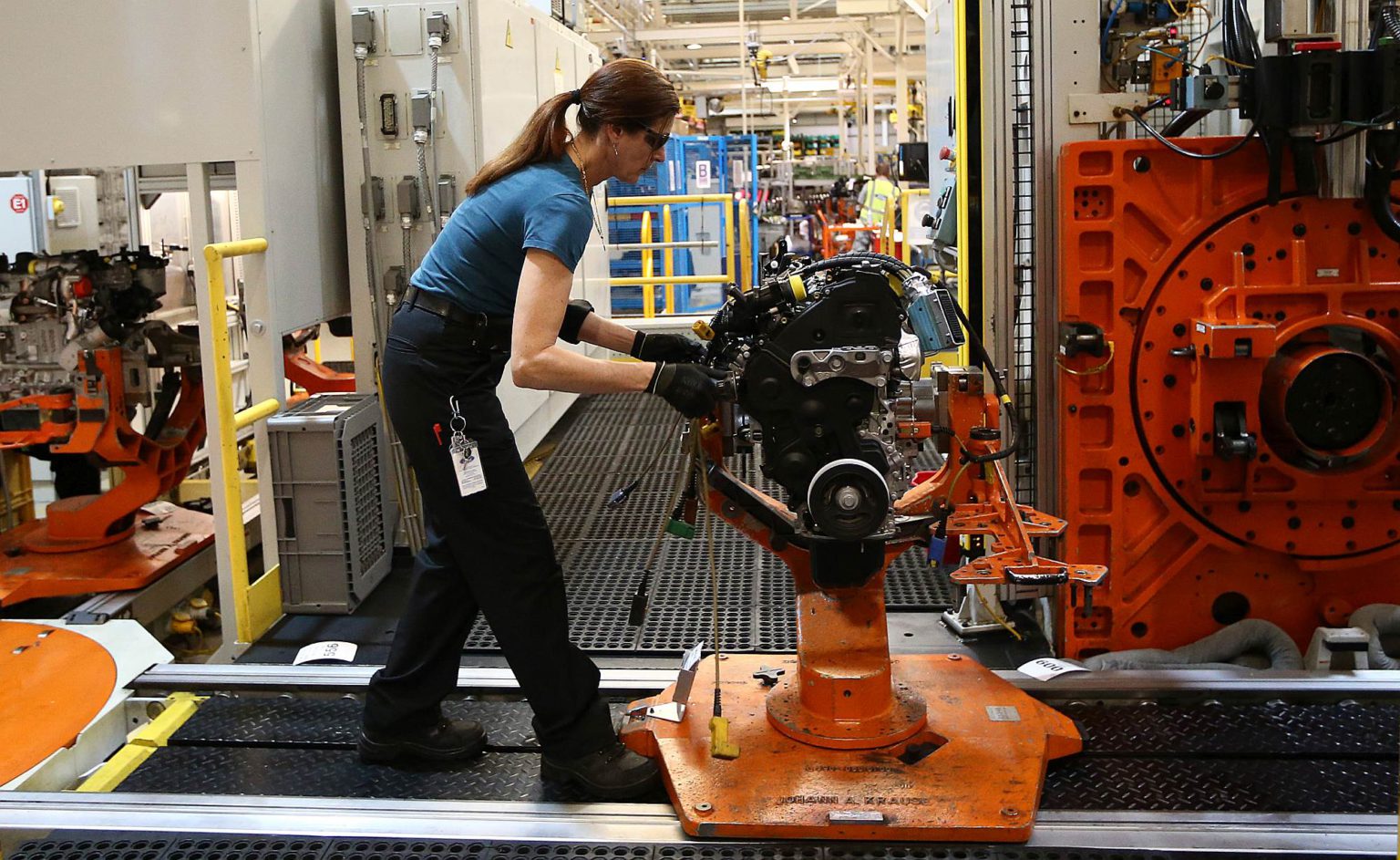

Such intervention, carried out by governments of all stripes, has gone far beyond the occasional bailouts of failing businesses, such as steel producers, carmakers or financial institutions. It encompasses a whole range of fiscal and policy measures designed to prop up ‘unviable’ parts of the economy.

For instance, official subsidies and public-procurement contracts have provided lifelines to larger businesses that otherwise would have been really struggling. The spread of ‘regulationism’ has tended to favour incumbent firms, not least because they have the resources and experience to handle rules and standards much better than start-ups and smaller challengers. Meanwhile, insolvency laws have been adapted to make it easier for indebted businesses to survive without having to transform and improve their production processes. And the lax enforcement of minimum wages and other worker protections has allowed companies, such as certain clothing suppliers in Leicester, to survive on the backs of their workers, rather than through deploying productivity-boosting technologies.

Much of the British economy is now dependent on these mechanisms for its survival. For the economy, this dependence is mediated through ever-rising indebtedness. It means that any flickers of economic wellbeing are mostly ‘borrowed’ from the future, rather than coming from wealth creation in the present.

Since the pandemic began, chancellor Rishi Sunak has been talked up as representing an economic breath of fresh air. However the various loan schemes to help businesses through their shutdowns, which are at the core of his support programme, are fully in line with what has gone before. The resulting legacy for many surviving businesses will be a still bigger burden of debt to service, even as Sunak insinuates potential corporate tax rises to fulfill his pledge to ‘balance the books’.

Sunak’s Winter Economy Plan statement further illustrated the continuity of his approach with that of recent governments. His claim that the longevity of the pandemic and the government’s shutdown measures are to blame for our economic troubles is consistent with the pretence that the economy was ‘fundamentally sound’ before coronavirus struck. Sunak justified winding down the furlough scheme on the grounds that the pandemic had caused ‘permanent’ economic damage. As a consequence, he said, there was no point sustaining jobs that were no longer ‘viable’. ‘It is fundamentally wrong’, he continued, ‘to hold people in jobs that only exist inside the furlough’.

It is likely this was just a crude face-saving exercise. As Sarah O’Connor noted in the Financial Times, ‘it is impossible to determine which jobs will be viable after the crisis ends while we are still in the middle of it. Economic activity remains warped by government restrictions.’ What was ‘fundamentally wrong’, as well as duplicitous, was Sunak using the very shutdown his government has introduced in order to vindicate abandoning a pledge to support businesses and workers through these exceptional times.

All sorts of occupations are today ‘unviable’ because of the government’s own measures. In particular, pretty much any activity that services people socialising together – from hospitality venues to sports centres to indoor retailing and leisure pursuits – has been made unviable by government restrictions and quarantines. While it is likely that economic opportunities will be different after the pandemic, it is neither easy nor useful to seek to predict which sectors and jobs will be viable or unviable in the future.

An economic plan for the 21st century

Still, while Sunak’s talk of economically unviable jobs was rather disingenuous, there is a broader point that is worth making here. In ordinary times, it should not be the government’s role to sustain or prop up unviable parts of the economy. This general insight opens up the possibility of a national plan for economic renewal. Hence, if we are to develop such a plan, it is imperative that governments stop trying to sustain the economic status quo. Their attempts to protect existing businesses simply preserve economic gridlock.

How then to deal with this state of atrophy? The past 40 years of slow-drift decay tells us that waiting for a spontaneous recovery is futile. Moreover, the usual economic policy proposals from across the political spectrum also fall far short of the task. The tired counterpositions – ‘tax-cuts and deregulation’ from the old right, and ‘tax-and-spend and reskilling the unemployed’ from the old left – miss the magnitude of the cultural, political and economic transformation required.

A society that lacks innovative energy and is reluctant to experiment with new ways of living and working will be unable to make something better from the approaching economic wreckage. Since successive governments and business elites have become so wedded to stability, we have to look elsewhere in society for the catalyst to, as Boris Johnson puts it, ‘build back better’. This means that economic transformation is much more dependent on the public’s willingness to embrace disruptive change than on any concrete transformation programme.

Sunak told the Tory Party conference that he wanted to ‘make it easier for those with the ambition and appetite to take risks and be bold, to do what they do best and create jobs and growth’. If we are to take Sunak at his word, here are three further principles he and his team should reflect on to realise his conference pledge: first, local planning combined with national action; second, properly supporting workers, not their old jobs; and third, an ‘investment first’ approach.

Plan local, act national

In today’s politically and socially cautious times, the question of how we transform the economy is key. The answer lies in popular participation. This will provide the vital spark for economic transformation. Renewal that creates new and better employment is going to be a disruptive process and needs to be tailored to the specific challenges in different parts of the country. No programme of change will work as a dictate from Whitehall. However smart are the government’s expert advisers, a plan that does not start with, and draw on, people’s local knowledge and resolve is not going to get far.

The broad methodology involves local ideas implemented with the help of national resources. The latter includes mechanisms such as public-investment banks, research-and-development labs, and decent transitional unemployment benefits paid from the Treasury. However, the specific ideas for building a better economy and durable jobs need to come from local and regional forums made up of workers, non-employed people, employers and relevant third-sector organisations.

Local-government personnel can facilitate these ‘councils for change’, but they should not run them. Genuine leadership from the ground is a hundred times more likely to kindle an ethos of risk-taking and experimentation than relying on people schooled in local or central bureaucracies. Drive from local people, with a strong incentive for successful renovation, is required to develop and implement these initiatives. Also, people in their communities are much better placed than functionaries to identify specific local strengths, weaknesses and opportunities for growth.

Support the worker, not their old jobs

Everyone deserves to be supported from the public purse during the transition from the old economy to the new. Once the government drops the Covid-shutdown measures – the sooner the better – the governing approach should shift to one of ‘support the worker, not the job’. This means providing an income to the newly and existing jobless, adequate for a decent life, until proper employment becomes available.

This is a legitimate use of public borrowing. Today Britain has one of the least generous unemployment-benefit schemes within the advanced industrial countries that make up the OECD. Before the pandemic arrived, benefits relative to previous in-work income across the OECD averaged about one half (47 per cent) for people out of work for 12 months. Britain languished in 35th place out of the 41 OECD countries, providing only 17 per cent of previous working income. Most other Western European countries were in the above-average range: from 54 per cent (Spain) to 78 per cent (the Netherlands).

Even tripling the miserly UK benefits to around 50 per cent of working incomes would cost a lot more than the existing universal credit budget. But this extra expenditure is far better used supporting people than used to prop up failing industries and firms. It is public spending that is aimed towards a stronger future, rather than sustaining a failed past.

The state should also ensure employers’ adherence to essential employment rules. Specifically, workers should be guaranteed an income floor of the living wage (extended to all over-18s), as well as safe working conditions. Failing in these two areas is not only demeaning and potentially harmful for people at work, it also encourages businesses to rely on low-cost labour practices rather than on investment in higher-quality technology.

Supporting workers through the transition also means ensuring that people are trained for their new jobs. This is another necessary state responsibility, but it is not sufficient as a means of job creation. Providing vocational training can keep some jobless people temporarily occupied, but it doesn’t ensure a return to employment when the core problem is a shortage of good jobs. Without genuine job opportunities, ‘training’ or ‘re-skilling’ measures can become substitutes for actual employment. Such training schemes can become demoralising if there are too few decent jobs available.

Job creation has to come first. Then the state can ensure employers orchestrate the necessary training for their new employees – for example with on-the-job training, sometimes supplemented by college courses.

Investment first

There is really only one practice that is going to rejuvenate the economy: transformative investments in new industrial sectors and businesses, accompanied by the creation of lots of well-paying, secure jobs. The question is: can the government do anything to bring this about?

Generally, governments do not create jobs directly (apart from ones in their own bureaucracy, and those for delivering vital public services, from healthcare to education). But what governments can do is help to shake up the old economy and generate the conditions for businesses to start up, or to transform themselves by investing in better technologies. This is the only long-lasting way to ensure better employment opportunities.

Economic progress through innovation ultimately relies on new ideas for improving production processes, products or services. However, even more important than ideas today is the business investment that realises these ideas within production. Most productivity gains come from the diffusion of existing good technologies – not necessarily from original ideas, but from good ideas actually being implemented.

This helps explain one of the paradoxes of our times: that an era of accelerating change is also one of anaemic productivity growth. The missing ingredient between headline-catching inventions and discoveries is the business investment that turns exciting ideas, or even relatively mundane ones, into innovations that are embedded within production processes. Without such investments, productivity cannot gain even from the smartest breakthroughs.

Successful economic transformation doesn’t need every business to develop ‘cutting edge’ technology. It would be a huge advance if outdated technology was simply replaced by the best that is procurable for particular sectors. The productivity growth on which durable prosperity depends requires businesses – established or new ones – to adopt the best technologies available from around the world to produce goods or deliver services more efficiently. Businesses do not have to develop these technologies themselves. Good technologies can be imported, taking advantage of today’s ever-more extensive international division of labour.

To aid all this the government needs to reverse the policies that reinforce economic congestion. This is more vital than the list of measures usually associated with state activism, such as building infrastructure, training programmes and even government research and development. Each of these has a role to play in reconstruction, but none will make much difference to productivity without us first unclogging the economy of the many just-about-managing businesses and sectors. Otherwise, there is little incentive for new businesses to start up, or for the existing businesses to invest in the latest technologies and expand.

Once the government stops trying to preserve the economic status quo, we can then look at how to generate new sectors, and create better jobs. In this regard, there are already plenty of good proposals out there. For instance, the idea of a national investment bank has been suggested. This would focus on venture-capital financing for new and expanding businesses. The state could also be much more generous in financing basic research in emerging areas such as biotechnology, new materials and next-generation transport systems, as well as the better known digital technologies.

Advanced research labs and agencies could also help produce some technological breakthroughs in areas for which there is already demand. Improved construction methods would help address Britain’s particular housing shortages. New nuclear and other advanced energy technologies would help replace wind, solar and fossil-fuel power, each with their own well-known disadvantages of unreliability, cost and pollution. All these existing proposals show that, in the policy arena just as in the business sector, the real contemporary challenge is less in the realm of generating ideas than it is in establishing the necessary cultural, political and economic conditions for their implementation.

To help establish these necessary conditions, the writer Matt Ridley has suggested that policymakers adopt something he calls the ‘innovation principle’, in place of the ubiquitous ‘precautionary principle’. The innovation principle instructs us to examine every policy, plan or political strategy for the impact it could have on innovation, and if you find evidence that the policy is going to impede it, then drop, change or rethink it. This shift in focus captures well the crucial perspective of risk-taking, which will provide the foundation for effective economic renewal.

The innovation principle can provide us with an important guide as we strive for economic renewal. There will be risks, of course. But we should not be put off by the potentially disruptive consequences of economic innovation, from failing businesses to lost jobs. For here the state can play a role, by ensuring that people are financially supported during this disruption. After which, we might finally be able to provide a better, more prosperous economic future for everyone.

Phil Mullan’s Beyond Confrontation: Globalists, Nationalists and Their Discontents is published by Emerald Publishing. Order it from Emerald or Amazon (UK).

Pictures by: Getty.

Spare a fiver, support spiked

Become a £5 per month donor today!

Celebrate 25 years of spiked!

A media ecosystem dominated by a handful of billionaire owners, bad actors spreading disinformation online and the rich and powerful trying to stop us publishing stories. But we have you on our side. help to fund our journalism and those who choose All-access digital enjoy exclusive extras:

- Unlimited articles in our app and ad-free reading on all devices

- Exclusive newsletter and far fewer asks for support

- Full access to the Guardian Feast app

If you can, please support us on a monthly basis and make a big impact in support of open, independent journalism. Thank you.

Comments

Want to join the conversation?

Only spiked supporters and patrons, who donate regularly to us, can comment on our articles.